capital gains tax rate australia

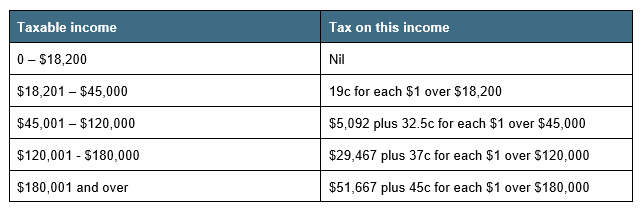

The tax on the capital gain would be 37. Companies are not entitled to any capital gains tax so if the property has been used as a place of business youll pay 30 tax on any net capital gains.

Doing Business In The United States Federal Tax Issues Pwc

Non-residents however have been excluded from this concession since 9 May 2017 subject to then existing.

. Companies with a turnover greater than 5000000000. If you own the asset for longer than 12 months you will pay 50 of the capital gain. At 20 percent the rate goes up to income levels above that.

There is a capital gains tax CGT discount of 50 for Australian individuals who own an asset for 12 months or more. Capital gains are only taxed at 15 percent if the taxpayers earn 40401 to 445850 annually. For SMSF the tax rate is 15 and the discount is.

This is the difference between what it cost you and what you get when you sell or dispose of it. 10 12 22 24 32 35 or 37. There is currently a bill that if passed would increase the.

It is probably somewhere between 30 to 50. If an asset is held for at least 1 year then any gain is first discounted by 50 for individual taxpayers or by 333 for superannuation funds. Hawaiis capital gains tax rate is 725.

Capital gains is treated as part of your income tax. However once the general 50 discount is deducted the taxpayer only declares 5000 capital gains income the tax on which at 37 is 1850. Some assets are exempt from CGT such as your.

Capital gains are taxed at the same rate as taxable income ie. No company is entitled to a capital gains tax discount and tax is imposed at 30 on any net capital gains if it is a company. In general there is no capital gains tax on the sale of your main residence.

Because the Capital Gains Tax is not a separate tax there is no capital gains tax rate as such. Tax Rate Capital Gains Australia May 13 2021 October 4 2021 Tax Bracket Rates by admin Tax Bracket Rates 2021 If youre currently working in Canada and are currently employed there you could be considering tax rates that are much lower than those for Americans. Your total capital gains.

Capital gains tax for business. Capital losses can be offset against capital gains. Companies with a turnover less than 5000000000.

Capital Gain Tax Rate. Your capital gain profit is 50000. She owns the shares for 6 months and sells them for 5500.

Capital gains tax in Australia for residents and non-residents There is a difference between the way in which residents and non-residents are treated with respect to Capital Gains Tax. Less any capital losses. Maree declares a capital gain of 500 in her tax return.

Its not a separate tax just part of your income tax. Your taxable capital gain is 25000 with the 50 CGT discount applied Your estimated capital gain tax payable is 9750. Of your net capital gain of 750000 you must pay 75 in capital gains tax which is 56250.

Capital gains taxes on profits gained from a sale to hold on longer than a year after sale. If youre an individual the rate paid is the same as your income tax rate for that year. Individual taxpayers must pay the same tax rate as their income tax rate for that particular year.

CGT is the tax that you pay on any capital gain. The same income tax rates apply to ordinary income and net capital gains income. Australian Residents if the asset is held for more than 12 months before the CGT event occurs then the calculated capital gain is reduced by 50.

Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets. You must then work out five-tenths of the capital gains tax which is 28125. Short-term capital gains taxes tend to be higher than long-term gains taxes.

The date you sell or. You pay tax on your net capital gains. Helping business owners for over 15 years.

You mustnt forget that a 50 discount applies because you owned the property for more than 12 months meaning your capital gains tax will be equal to 140625. Capital gains tax rates for the long term are low 0 for taxable income and higher 15 for taxable income. Australia Corporation Capital Gains Tax Tables in 2022.

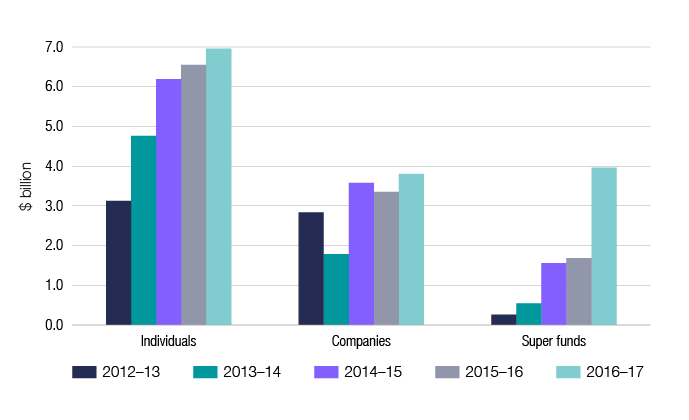

You will need to complete a tax return to claim it back. A third of gains on assets in superannuation funds is also excluded from income producing a top rate of 10 percenttwo-thirds of the 15 percent flat tax rate on superannuation earnings Nonetheless Australias rate is very high compared with New Zealand which does. The top tax rate on ordinary income is 465 percent this makes the top capital gains tax rate 2325 percent.

You sold your investment property for 600000. Capital Gains Tax Estimate An approximation of the amount of capital gains tax you need to pay to the government for the sale of your property. However if the asset is owned by a company the company is not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains.

She has no other capital gains or losses. She will pay tax on this gain at her individual income tax rate. If you earn 40000 325 tax bracket per year and make a capital gain of 60000 you will pay income tax for 100000 37 income tax and your capital gains will be taxed at 37.

If you sell a house in Australia add the capital gain to your tax return for that financial year. That applies to both long- and short-term capital gains. And for SMSF the tax rate is 15 and the discount is 333 rather than 50 for individuals.

The amount of capital gains taxable income below 40400 will qualify the person for tax relief in 2021. If you are an individual the rate paid is the same as your income tax rate for that year. Effective Tax Rate This is the rate at which you are taxed for the capital gains and depends on your income during the financial year.

Your current taxable income is 95000. If your business sells an asset such as property you usually make a capital gain or loss. Net capital losses in a tax year cannot be offset against normal income but may be carried forward indefinitely.

Less any discount you are entitled to on your gains. An individual taxable as a member of the SMSF has a 20 tax rate while he or she has a 33. This means you pay tax on only half the net capital gain on that asset.

The effective tax rate on the capital gain of 10000 is 185. If youre a company youre not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains. If you do not pay income tax in Australia the purchaser will withhold 125 of the purchase price for ATO.

6 Resident Versus Non Resident Tax Status

Capital Gains Tax On Shares In Australia Explained Sharesight

The Ultimate Australia Crypto Tax Guide 2022 Koinly

What S Your Tax Rate For Crypto Capital Gains

End Of Financial Year Guide 2021 Lexology

Tax Loss Selling For Australian Investors Sharesight

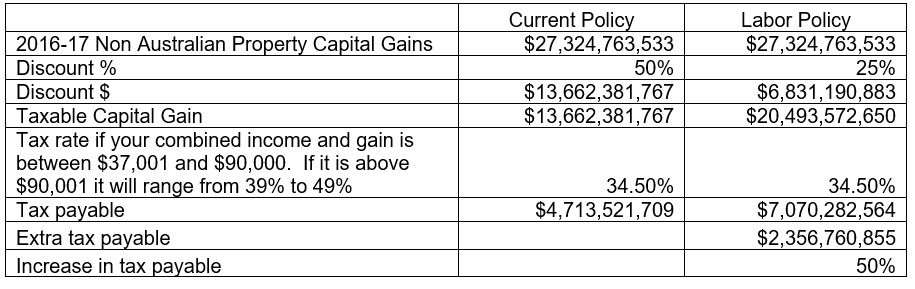

Is Bill Shorten S Changes To Capital Gains Tax Just Revenue Raising

Taxation In Australia Wikipedia Capital Gains Tax Income Tax Return Payroll Taxes

Capital Gains Tax Building Depreciation Home Property Management Residential Property Management In Launceston Tasmania

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

Capital Gains Definition 2021 Tax Rates And Examples

Capital Gains Tax Australian Taxation Office

What S Your Tax Rate For Crypto Capital Gains

How To Minimise Capital Gains Tax Cgt

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

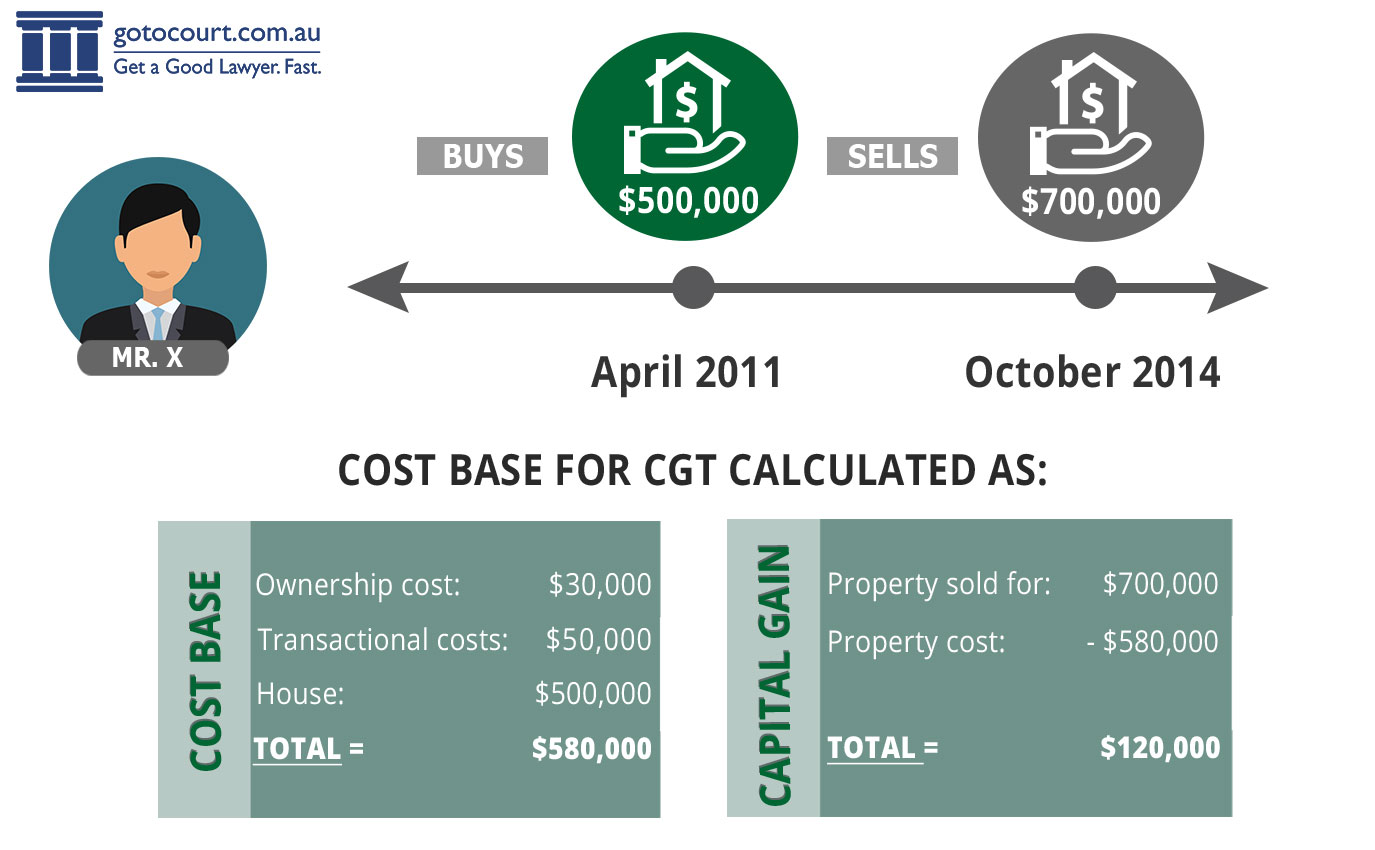

Calculating Capital Gains Tax Cgt In Australia